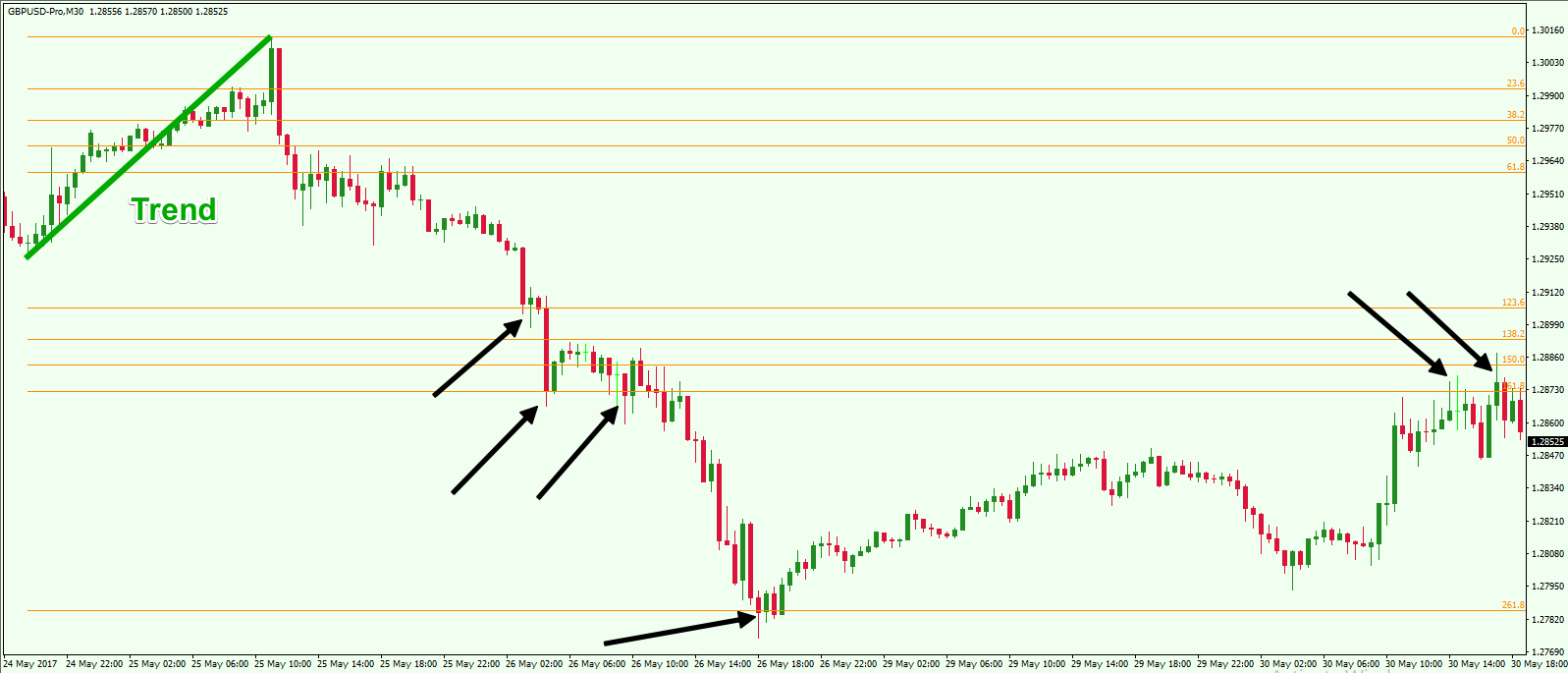

In this case notice that price went down to 1618 fibonacci extension level and bounced back up. Fibonacci extensions know when to take profit in forex improve your forex trading by learning how to use fibonacci extensions to know when to take profit.

Fibonacci Retracement Levels In Day Trading

Fibonacci Retracement Levels In Day Trading

This article looks at how fibonacci extensions are calculated and how they can be used by forex traders.

Forex fibonacci extens! ion. Subscribe subscribed unsubscribe 6k. Fibonacci extensions are also sometimes referred to as fibonacci expansions or fibonacci projections and are external levels that go beyond the 100 level. To grasp fibonacci extensions first you need to know about the fibonacci sequence the key fibonacci ratios and the widespread if unfounded belief that financial market prices move according to these numbers.

Knowing such behavaviour you can set your take profit targets on 1618 level. For the fibonacci retracement on uptrend and downtrend i easily understood and was able to applyuse it. Fibonacci retracement extension forex trading strategy trading walk.

Forex prices do not continue rising up all the time in an uptrend market. You determine the fibonacci extension levels by using three mouse clicks. In an uptrend the general idea is to take profits on a long trade at a fibonacci price extension level.

There! are also countless fibonacci tools from spirals retracements ! fib time zones fib speed resistance to extension. Fibonacci on extensions now were going to examine the move beyond the retracement often known as an extension and we will measure extensions using the same fibonacci levels. How to draw a fibonacci extension in an uptrend.

This is a follow up to how to calculate and use fibonacci retracements in forex trading. You may already be familiar with these important fibonacci levels 236 382 500 and 618. Unsubscribe from trading walk.

Common fibonacci extension levels are 618 100 1618 200 and 2618. The fibonacci extensions show how far the next price wave could move following a pullback. The fibonacci tool is very popular amongst traders and for good reasons.

The first section looks at the fibonacci sequence and how the extension levels are calculated. The fibonacci is a universal trading concept that can be applied to all timeframes and markets.